Jot Notes: General Thoughts on AutoZone + Vontier's Investor Day

The following are some notes I wanted to share on two companies in the internal combustion engine (“ICE”) ecosystem, AutoZone and Vontier.

In the past year, most of the better known quality ICE stocks have done well so I don’t think anything I’m going to write about is particularly novel or not well understood.

There are still some small cap companies in the ICE ecosystem that have not seen much multiple expansion. Vontier fits that category and I’ll share some interesting points from their recent investor day. Please reach out to me if you see any errors or can add some clarity to anything that follows.

AutoZone:

Car Parc:

Light vehicle fleet in the US - 280M vehicles

Annual scrappage - 13M vehicles

Normalized annual new light vehicle sales - 16.5M

Average age of the active fleet has been increasing at ~0.2 years per year and currently, average age stands at 12.2 years

Natural growth in the car parc of 4M-5M vehicles

EV sales likely need to be 30% of total new light vehicle sales (~4.5M) for the number of ICE vehicles in operation in the US to flat-line and greater than 5M for the ICE light vehicle fleet to enter decline

My guess is 30% penetration is going to be at least 5-7 years away. Your guess is as good as mine. I think affordability constraints, culture/habits, limitations of EV technology, and constraints on rapid increases in EV production all mean that 30% is not going to happen tomorrow.

For AutoZone’s core addressable market of cars aged 6-15 years, a decline in the ICE active fleet is therefore likely 12-15 years away

In that interim period, AutoZone will continue to grow its business. Larger, better run distributors such as O’Reilly and AutoZone will continue to take share from the rest of the industry as they have better inventory availability and distribution.

AutoZone is expanding its store base by 2.5% per year. Historically, AutoZone focused almost exclusively on retail customers i.e. “Do it yourself” parts sales, but has invested in building the infrastructure and practices to sell into commercial repair shops. The commercial “Do it for me” business is now more than 25% of sales and growing double digits. AutoZone has only ~5% market share in B2B parts distribution and as long as AZO keeps executing, there will be limited constraints on growing this segment of the business at 8%-10% for a long time.

One of the less well understood factors about auto parts retail is that it is a zero / slightly negative unit growth industry. Technology gets better, cars are more durable. The offset is that cars are designed to fit consumer budgets and consumers trade up for cars with better tech.

Comments by AutoZone management:

2023 - “Basically, for the 28 years that I've been in this business, there has been transaction count declines”

2022 - “You've heard me say many times that the dirty little secret of our industry is that there's downward pressure on units and have been for decades…You used to buy spark plugs and they were copper spark plugs and they would last for 30,000 miles. Now you buy Iridium spark plugs and they last 100,000 miles. Now the old copper spark plugs used to cost $0.59. Now Iridium's are often times over $10. So there's an upward pressure on cost or price per piece and a downward pressure on units.”

2016 - “One of the things we always used to say is that one of the things that is inherent in the industry is the slowdown in traffic…What you have seen is traffic being flat to slightly negative with an inflation on your average ticket.”

Industry management teams say this extends to electric vehicles as well. EVs will follow the better quality → lower transaction count → higher price pattern.

LKQ:

“When you look at hybrid electric vehicles and battery electric vehicles, technical service parts command anywhere from a 2x to 6x premium relative to their comparable internal combustion engine counterparts. And there's a number of reasons for that. One is the technical complexity, not just with batteries, but also with the electrification of components previously belt-driven such as air conditioning, compressors and water pumps.

For an example, this is just one example. A 2013 Prius with an electric water pump, that water pump sells for 3x the value of a 2013 Corolla that has a belt-driven water pump. In the U.K., for example, a 2017 Golf with an internal combustion engine, that water pump sells for about GBP 77. The Lexus hybrid EV, the water pump is GBP 278. And so yes, the EV parts are much more expensive. We think that's going to continue to be the case for a long, long time.”

A question I have is whether EV components being at higher price points vs. similar ICE parts is due to structural reasons or whether costs will converge as EV parts makers get more manufacturing scale? LKQ seems to be implying it is structural but I’d love more clarity since I’m no engineer.

ADAS: If you’ve bought a new(er) car recently, you will have noticed how many more sensors and cameras there are on cars today versus 5-10 years ago. According to Vontier, a windshield replacement that requires sensor/camera recalibration costs 2.2x more than a traditional windshield replacement and also requires special tools. ADAS will help drivers get into fewer accidents and help vehicle durability but will likely come at a higher unit cost. ADAS has also created opportunities for O’Reilly and AutoZone to sell new kinds of repair tools to garages so they can handle the oncoming more complex repair work.

Since ADAS is still very new, it has not really started to contribute to AutoZone. Keep in mind, AutoZone’s bread and butter is cars that are already quite old, usually >5 years. I’m no engineer and I have no idea how much of a contributor these more expensive systems will be to AutoZone’s growth but we will find out over the next half decade. Better quality → lower transaction count → higher price.

What is unique and attractive about AutoZone and O’Reilly versus other companies that live off of the ICE ecosystem is that a replacement from an ICE vehicle to an EV doesn’t make AZO irrelevant. If you buy a Tesla, you will never fill up on gas again. Tesla as an OEM will never buy a Garrett turbocharger. You will never go to Jiffy Lube again. But you (or your mechanic) might order a part from an AutoZone store.

Undoubtedly, there will be a significant fall-off in transaction counts at AZO when a customer switches from an ICE to an EV, but it won’t go to zero. According to researchers funded by the Argonne National Laboratory, hybrids and EVs will generate a much lower but still substantial amount of aftermarket repair and service work.

A caveat: It is early days and EV cars are still very new so data quality is quite poor. There are very likely going to be differences between these forecasts and future reality, but it is true that an EV owner will still face parts malfunction even if it happens much less frequently.

So what seems very likely to me is that AZO will continue to grow over the next decade or so. AZO can likely keep growing very modestly even when the ICE fleet starts to tip into decline as there is still B2B market share for the company to take. Other ICE dependent companies may not have anything to sell into the EV ecosystem but AZO will mostly be able to replace ICE dollars for hybrid and EV quarters or 50 cents, which should allow the business model to live.

Vontier Investor Day Notes:

VNT has 3 main businesses.

Matco Tools (~25% of FCF) is the #2 retailer/distributor of tools and equipment to auto repair shops in the US/Canada after Snap-On. It was acquired by the ex-parent Danaher in 1986. The core drivers of the business are quite similar to AutoZone and O’Reilly. After all, both Matco and AZO/ORLY (in their B2B segment, have the exact same customers, auto repair shops):

Sweet spot is >7 year old cars

Revenue from EV vehicles will not be zero

Similar level of organic growth - MSD

ADAS is a medium term growth opportunity - new kinds of calibration tools needed by repair shops

Fuel Solutions (~45% of FCF) is the largest manufacturer of fuel dispensers (gas, diesel, CNG) with >50% market share. Unlike Matco, this is a global business. VNT’s install base is ~1 million fuel dispensers at ~260K gas stations. This industry is highly regulated for safety and environmental reasons and therefore is a high barrier to entry, 2 player market. They also manufacture components that sustain the underground storage tanks in a gas station such as tank gauges, contamination and leak detectors, pumps etc. As an aside, Larry Culp got his first job at Danaher in 1990 in this division.

Fuel retailing is again, like Matco and AZO/ORLY, an after-market business. The figures above regarding the slow changing composition of the fleet apply. But there are some interesting specifics.

In America/Canada, as my friend Lawrence Hamtil has pointed out, 10% of drivers are responsible for 32% of fuel consumption. I suspect a significant portion of this 10% are in professions such as the trades or farming and also use larger vehicles that are often hauling weight. The bottom 60% of drivers use less fuel than this 10%. The average EV buyer (today) is much more likely to be in that 60% pool than in the 10% super-user pool. EV owners in America may drive half the miles on average as the average ICE car owner, although again the data is not yet of high quality and I suspect the real difference is less stark. Nonetheless, one new EV is not worth exactly one ICE vehicle in terms of reduced fuel consumption.

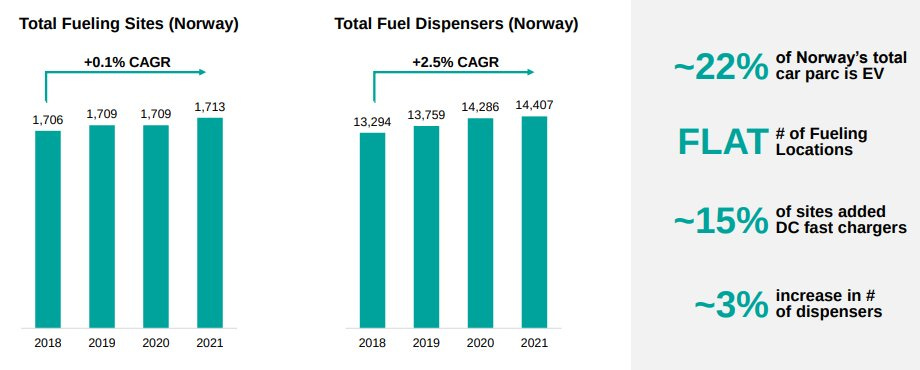

There is some proof in the pudding. Norway’s EV penetration is now where America may be in ~15 years.

Source: Vontier Investor Day

Other large markets for VNT such as India will take even longer than 15 years to get to 22% of the fleet being EV. More than 40% of segment revenue in 2023 will be overseas, mostly in emerging markets where there is a stronger tail-wind of increased car ownership and infrastructure build-out to support such growth and consumers keep vehicles a lot longer.

That said, the overall market is still a low growth one because the number of gas stations is not increasing at all in developed countries. In the US, the ~60% of the industry that is made up of single site operators are losing the battle to general retailers with fuel operations like Costco, larger operators like Circle K and regionals like Buc-ees with much better in-store offerings of food and beverages and lower costs. VNT is fortunately very strong amongst the larger players with 60% share.

Source: Vontier investor day

VNT also owns the #1 vertical market software for EV charging networks in the Nordics. It is expanding this software to other markets in Europe - who knows if that will work. The VMS generates a tiny amount of revenue today and is growing quickly but we are probably way too early in the development of the EV ecosystem to know whether this software will be Lotus 1-2-3 or Excel so I don’t really have much hopes here. I think one must be willing to rest any investment case on the core business instead of hoping that VNT’s “Watson” really works out! (Gulp, I guess I really did make that analogy).

Retail Solutions (i.e. Integrated POS) (30% of FCF): The fuel station/c-store itself is an interesting business model. 65% of transactions at Couche-Tard and the industry broadly are in-store only. Blue collar workers who are on the road often or work outside use these convenient stores to fuel up (!) with energy drinks, snacks and hot foods. Tobacco enjoyers (tobacco sales make up somewhere between 30% - 50% of c-store sales in the US and Canada) are another customer base that rely almost exclusively on the c-store channel as mass market retailers and drug stores have ceased selling traditional nicotine products. This profit pool is growing for c-stores due to tobacco free nicotine products like vapes and Zyn.

Again, we can look to the Nordics to understand the future. Here is data from Couche-Tard’s European stores (primarily Nordics):

Same store merchandise sales vs. same store fuel volumes in Europe for Couche-Tard:

23ytd - 3.1% vs. (3.5%)

22 - 5.9% vs. 3.8%

21 - 6.1% vs. (6.4%)

20 - 0.1% vs. (3.9%)

19 - 4.8% vs. (0.9%)

18 - 2.7% vs. 0%

VNT’s retail solutions segment provides an integrated set of hardware and software that help c-stores accept payments, reward customers with loyalty programs, self-checkout etc. This business is very similar to some of the vertical market integrated POS brands inside Global Payments ($GPN) and was of course built off of the distribution prowess of the fuel solutions segment. It’s a good business. It’s not pure VMS but the pairing of software, payments and hardware creates an integrated solution that can handle the vast majority of the workflow needs of the local small business c-store.

VNT also owns the #1 integrated POS business selling to the car wash industry which is growing at HSD%. That vertical should do >80M in EBITDA in 23, a sizable business.

Both of these businesses are not going to be too affected by shifts from ICE to EV.

What is different about VNT fuel solutions is that usage of VNT’s dispensers does in fact go to zero for an EV owner. In an EV world, like AZO/ORLY, Matco and the integrated POS business inside VNT will find their level and exist in a new steady state 30 and 40 years from now, though probably with lower margins. However, in that world, VNT’s fuel solutions business will be like IBM’s mainframe business.

Because the fuel solutions business is already quite mature and hardly grows and the other two divisions inside VNT are likely to grow MSD%, there will be a remixing over time as Matco and Integrated POS become a larger and larger part of the overall enterprise.

Capital Allocation: The management team of VNT has a concrete strategy of using capital deployment to reduce the percentage of ICE dependent revenues. This carries a lot of risk. Companies that feel they must find new avenues for profits or face existential risks are going to be less disciplined. Berkshire (textiles) diversifying away from their starting base while still making high ROIC decisions is the exception not the rule.

The acquisition of DRB, the integrated POS for car washes, is tracking well. The VMS for charging networks is growing quickly but is a more speculative use of capital. A small tuck-in acquisition in the retail solutions segment is, according to management, earning a 20% ROIC.

Management so far is talking the talk in terms of being focused on ROIC and the track record is fine. Management has demonstrated that M&A takes a back-seat and they prioritize buybacks when they believe the stock to be cheap. They’re children of the Danaher system so their plans are KPI focused and not too pie-in-the-sky. The rewards of pulling off diversification while maintaining ROICs are very high (strong multiple expansion) but it is not an easy thing to do and carries a fair bit of risk.

Addendum:

After receiving some feedback and thinking more about the above, I wanted to add a few additional thoughts.

Over-worrying about a what a business will be like >20 years from now is a bit of an exercise in “brain damage” as someone put it to me on Twitter. There are ways to deal with future uncertainties (diversification, turning your buyback into a dividend, not doubling down…) and that’s probably a better way to go about it than making 50 year DCFs and gaining false confidence.

With that said, there’s probably a tendency to think of any new oncoming change as the most important and biggest change ever. It always feels that way to us now. In one particularly salient moment from 2009, ORLY’s management described what a step change there was in vehicle quality from the 80s to the 90s/early 2000s as both technology improved and the entry of the Japanese massively raised the quality levels of the entire industry.

Had I had foresight into that, I’d have likely thought “Oh my god, these new Japanese cars’ designs are so superior, they will only require half the repairs of the current fleet which is always breaking down! This will be quite a big headwind for AZO and ORLY.”

The former is basically what happened. Here is ORLY:

“I think that the American consumer is going to find out that the vehicles that were built in the '90s and early 2000s, that those vehicles can be driven at very high mileages safely and without trouble if they're maintained correctly. I think most of us have realized that vehicles these days just don't have as many problems as they used to from a drivability standpoint. They still take maintenance, still take brakes, belts and hoses, stuff like that, but you don't have problems with the cold starts when carburetors didn't work when the chokes didn't operate correctly and things like that.”

But it ended up being a tailwind because the cars were so much better, consumers kept them for much longer and were willing to invest more dollars back into maintaining them.

Going through the old readings, so often AZO and ORLY describe the same phenomenon. Every single part and system of a car today requires less maintenance than it did 5 or 10 or 15 or 20 years ago. Every part fails less often than it used to.

The old heads at O’Reilly may remember the freak-out in the auto parts retail industry as vehicles switched from carburetors to fuel injection pumps. They used to sell a lot of those! The new fuel pumps failed at a fraction of the rate but cost $200 when the old fuel pumps cost $40. Or perhaps when computers first started being added to cars and there was a belief that the DIY market would die as no layperson would have the skills to know how to fix such complicated machines.

I think I would rather stick to the tools we have as investors to manage uncertainty rather than imagine wild futures from the vantage point of today while forgetting all of the massive change that has happened in the past.